Customers

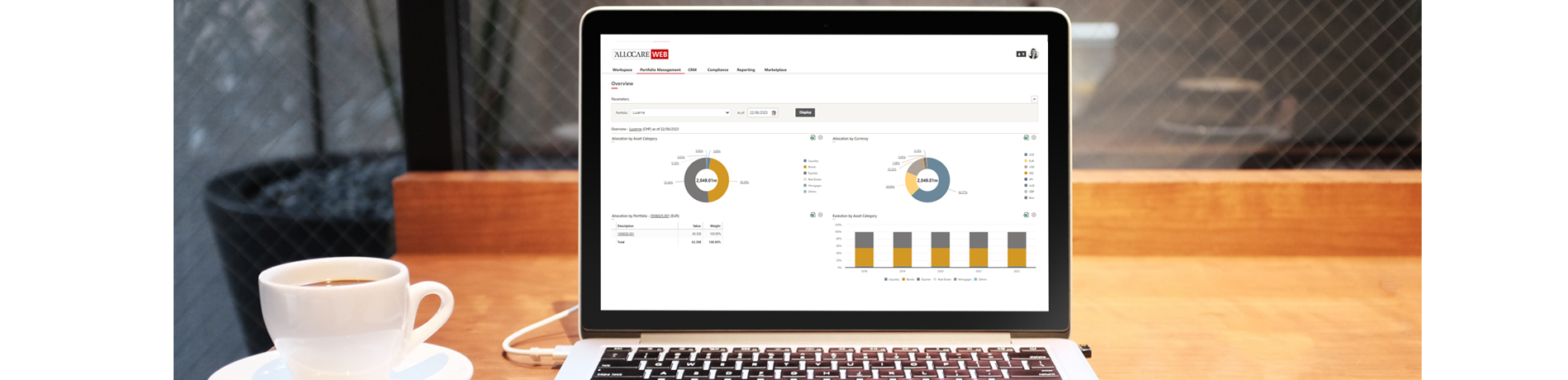

For more than 20 years, customers from various sectors of the financial industry in Switzerland and abroad have placed their trust in our Swiss software products and the associated services. The satisfaction with Allocare AMS and Allocare WEB as well as our various services and the long-standing loyalty of many customers are the best proof of the quality of our solutions.

We are mainly active in the following customer segments: