Products

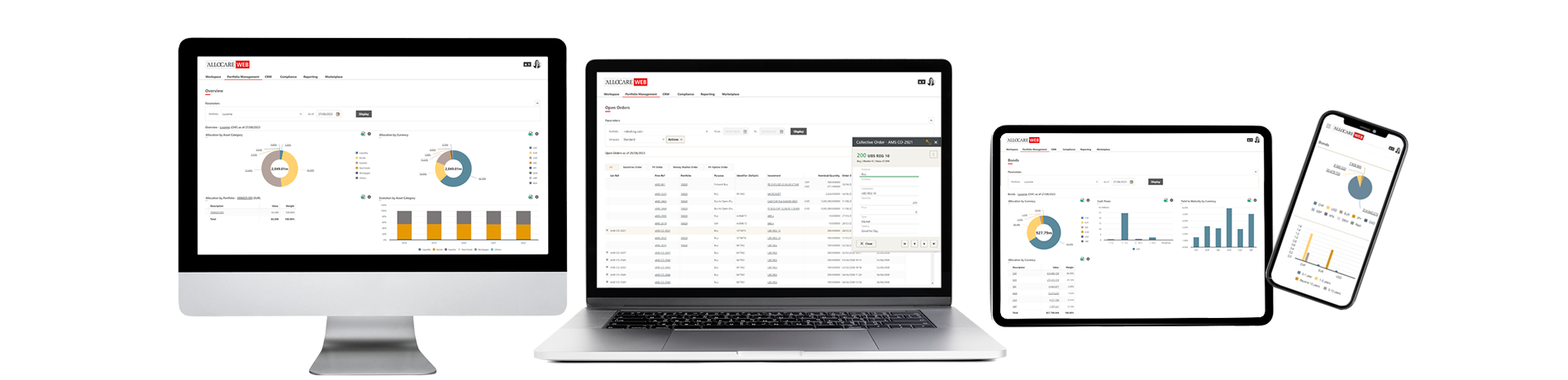

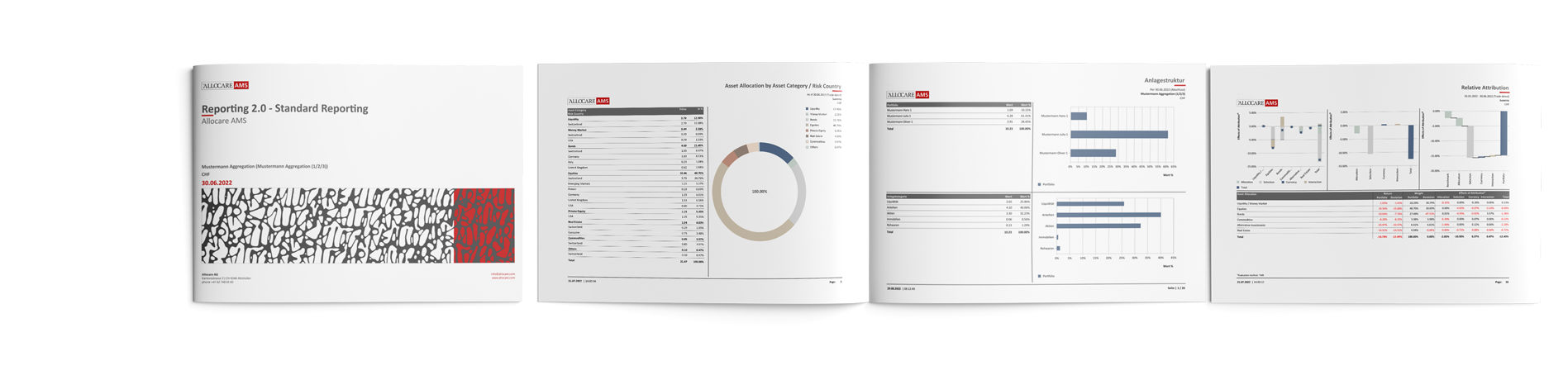

With Allocare AMS, Allocare WEB and various add-on modules as well as interfaces, we provide a comprehensive product range along the value chain in wealth & asset management.

Modules

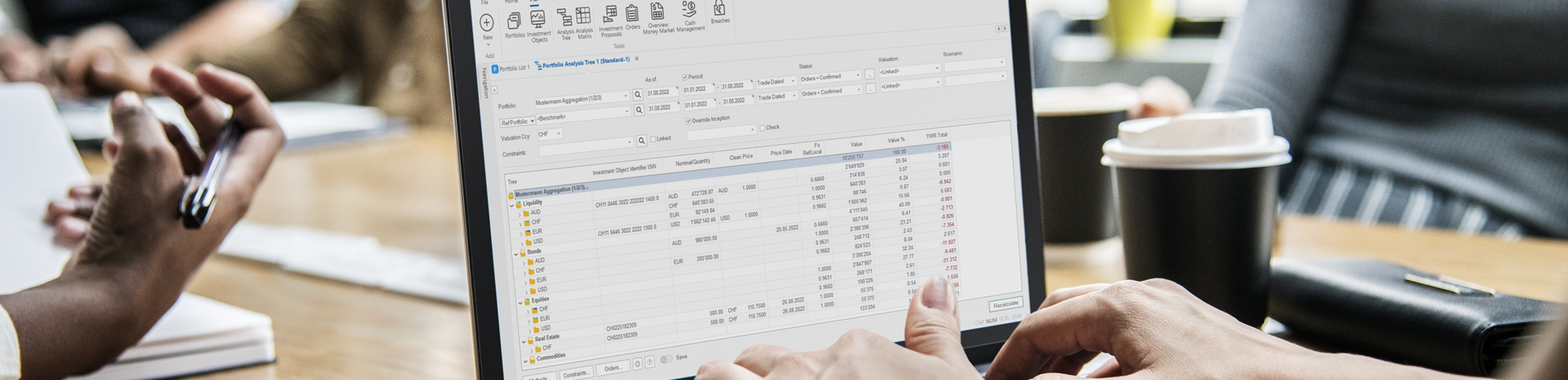

Our standard software Allocare AMS can be supplemented with additional modules. We are constantly developing these and create new modules, in line with regulatory developments in the financial industry and the needs and requirements of our customers.

Interfaces

Your connection to the outside world - our interfaces

Our universal GDF import/export interface connects Allocare AMS with the outside world.

Transactions, orders, master data, prices and exchange rates from different providers and custodian banks are automatically loaded into Allocare AMS or exported from there into other systems, if needed.