Allocare AMS

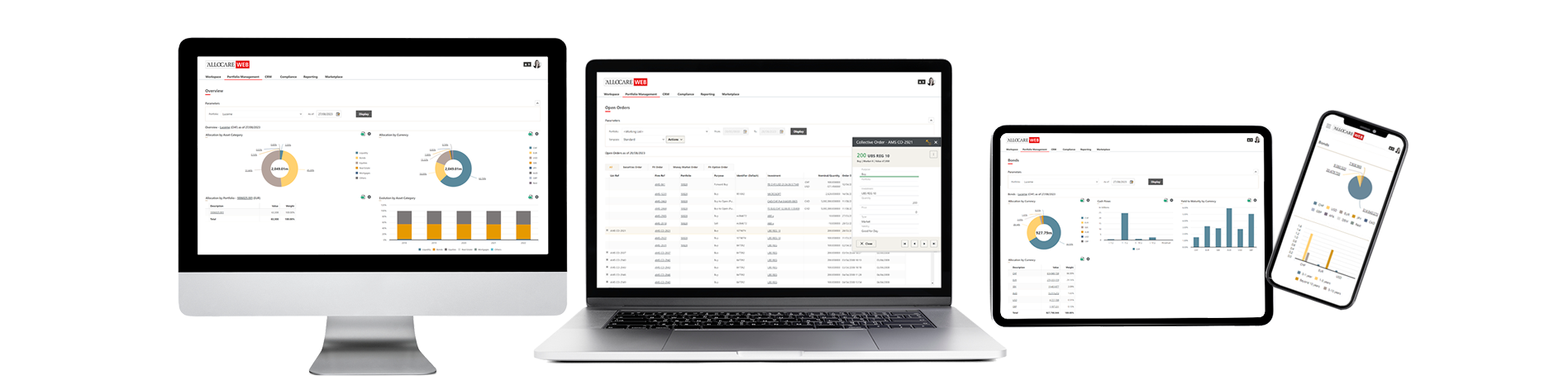

Our portfolio management software Allocare AMS offers you the technological prerequisite to keep your customers' assets under control at all times and to manage them comprehensively. The modular software offers the right solution for the various tasks at hand. areas of application.

Allocare AMS supports your daily work efficiently, from onboarding to ongoing customer care and reporting. It makes sure that your business processes are adhered to, that you meet regulatory requirements, and that you can provide evidence of these requirements.

All data is held centrally and is available to authorized users according to your access model. Comprehensive analysis methods support you in evaluating performance and risk at every level. Flexible reporting options for customers, compliance & risk as well as the management of your company round off the product.

Allocare AMS can be efficiently integrated into existing IT system landscapes, it is cloud-enabled and has standard interfaces to common market data providers, core banking systems and a large number of custodian banks.

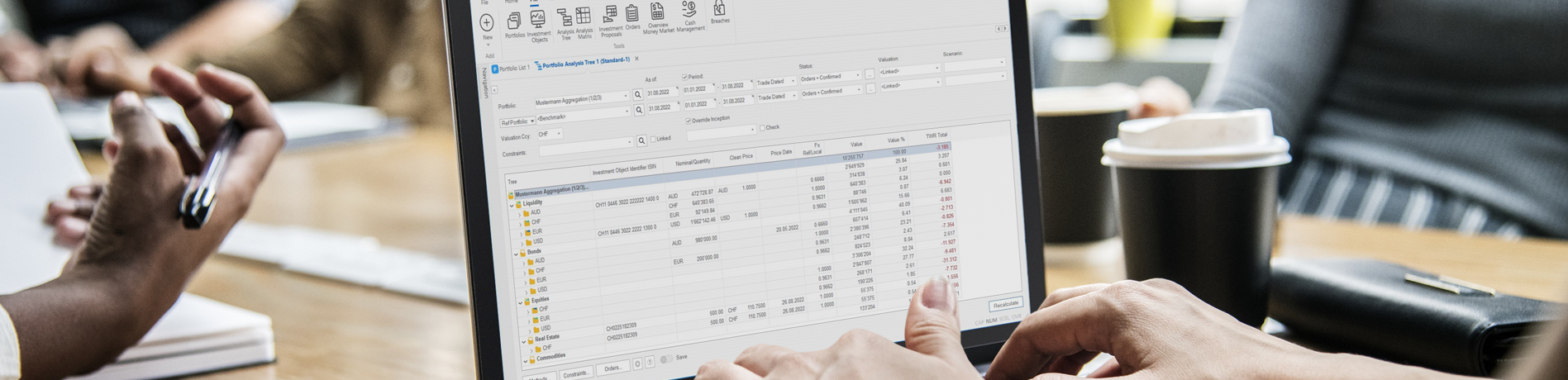

Portfolio analysis

- The Analysis Tree is the heart of our software

- Flexible evaluation and display of assets at any level and according to freely definable criteria

- Various performance and risk analysis methods can be flexibly sorted and grouped

- General and individual analysis templates can be saved

- Order simulation, scenario testing and more

Data management

- Clear management of instruments, portfolios and customers

- Easy loading of master and market data with standardized interfaces to custodian banks and market data providers

- Complex structures such as fund of funds, aggregations, non-bankable assets, investment pools or families can be mapped easily and flexibly

- Audit trails, historized data and document archive over the entire life cycle

CRM

- Customer information, incl. risk classification and document storage

- Note functions for client meetings and regulatory requirements

- Checklists and reports for back and middle office (e.g. price checks, appropriateness and suitability of investment products)

- FIDLEG and MiFID II

- Connection to external systems, if requested

Trade Order Management

- Flexible configuration of the order management process (authorizations, 4-eyes principle)

- Simulations of reallocations or investment proposals

- Pre- and post-trade checks

- Single or collective orders

- Rebalancing against model portfolios

- Cash sweeping and order routing

Compliance audits

- Flexible editor for defining legal and client-specific investment guidelines

- Pre- and post-trade checks

- Freely definable, automatic test points in the process with 4-eyes principle

- Breach management workflow with function-dependent authorizations

- Audit trails

Legal Guidelines:

- Rule sets for fund laws of the various jurisdictions (e.g. Luxembourg, Liechtenstein), BVV2 and investment guidelines for insurance companies

- MiFID II solution, including automatic transaction reporting to the regulator (MiFIR)

Transaction Management

- Entry of all transactions by means of editor

- Interfaces to the most important custodian banks for automated loading of transaction and position data

- Automatic comparison of new transactions with open orders (matching)

- Reconciliation tool

- Comprehensive transaction analysis including transaction cost comparison target/actual possible

Performance and risk measurement

- Performance calculations - TWR, MWR, IRR - at any level with any selection or aggregation, "on the fly" or time series based

- Performance Attribution and Contribution

- Fixed Income Attribution

- Various VaR calculations (historical, Monte Carlo, etc.)

- Scenarios and stress tests

- Key risk figures

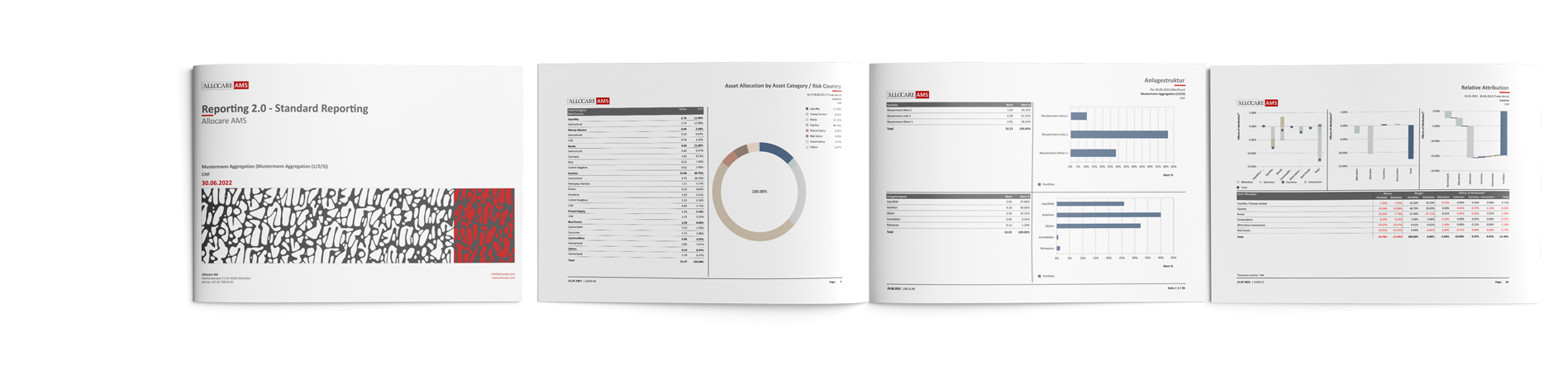

Integrated reporting functionalities

- Comprehensive package of standard reports

- Customization possible

- Consolidation of assets at any given level

- Easy creation of dashboards

- Report books with integration of external data (e.g. market comments, etc.)

- Multitenant capabilities, with individual look & feel design and white label options

- Creation of your own report compositions

Billing

- Automated calculation of management fees according to various parameters (fixed, volume-based or performance-based) with selectable periodicity

- Automated invoice generation

- Control of allocated transaction costs against pre-calculated target amounts

GIPS® (Global Investment Performance Standard)

- Aggregation of portfolios into composites and their monitoring

- Calculation of performance and risk metrics in compliance with GIPS®.

- Comprehensive package of GIPS®-specific reports

- Support of internal control processes